Investing in farmland REITs can be tricky if you don’t know where to start. This article explores some of the best farmland REITs to help you make that wise investment decision.

Land is arguably the most stable asset class in the market and has been for centuries. Whether you buy land to resell, farm, or bring up some rental properties, land rarely disappoints.

Farmland investments are a great way to grow wealth, especially since you are almost certain of the return on investment. In addition, it’s one sure way of hedging your finances against unpredictable inflation.

However, investing in farmland hasn’t been easy in the past. It was normally seen as an investment for the rich and mighty. Mainly, this is because it required a lot of upfront investment, which most new investors couldn’t afford.

But this is not the case anymore. Farmland REITs and various farmland crowdfunding companies make everything easy. Now, numerous low-cost agricultural investing platforms allow anyone to invest in farmland.

So, what are some of the best farmland REITs you can rely on? With Robinhood, you can access the best REITs without any brokerage commissions. And it allows you to buy fractional shares.

Table of Contents

- Best-Of by Category

- Best Farmland REITs

- 1. Gladstone Land

- 2. FPI – Farmland Partners

- 3. Farmland LP (Private REIT)

- Farmland REITs Alternatives

- 1. FarmTogether

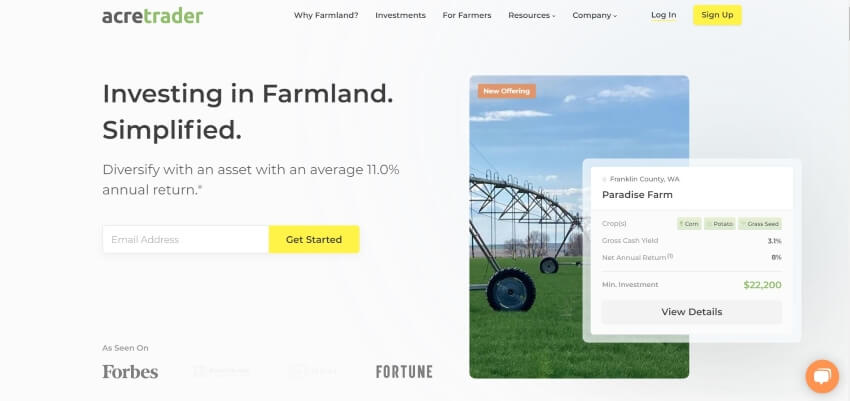

- 2. AcreTrader

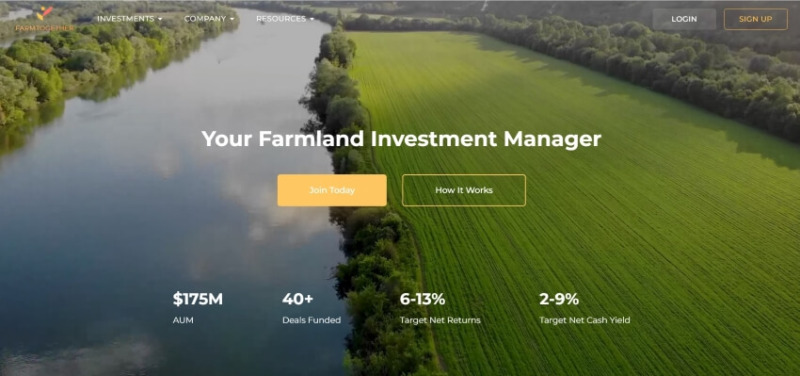

- 3. FarmFundr

- 4. Steward

- 5. Harvest Returns

- Pros and Cons of Farmland REITs

- Pros

- Cons

- What are Farmland REITs?

- Types of Farmland REITs

- Buying a Farmland REIT

- FAQs

- Are farm REITs a good investment?

- What is the largest farmland REIT in the US?

- Is there an ETF for farmland?

- Are there REITs that invest in farmland?

Best-Of by Category

| Category | Product |

|---|---|

| Best for Long-Term Investment | Gladstone Land |

| Best for Immediate Returns | FPI – Farmland Partners |

| Best for Private Investment | Farmland LP (Private REIT) |

| Best for Hands-Off Investment | FarmTogether |

Investors have access to a vast number of options for gaining exposure to this alternative asset with low management fees, secondary-check, an easy-to-use online platform, ability to diversify farmland holdings across the country in minutes.

Investors seeking uncorrelated returns from traditional asset classes such as stocks and bonds can find welcome diversification with farmland. With strong absolute returns and absolute returns, FarmTogether will help you reach your financial goals.

FarmFundr allows you to invest in farmland, a tangible asset that provides a stable and reliable investment opportunity. Our managed agribusinesses are carefully selected, offering investors the chance to diversify their portfolios through agricultural real estate. Invest in farming today!