A certified minority-owned business enjoys many benefits. Some of them include state funding and accessibility to more business contracts. But to get the certification, your business must qualify as minority-owned.

Minority-owned businesses are typically small business enterprises. They are prevalent throughout the United States and form the country’s economic backbone. Minority businesses also provide employment opportunities to millions of American citizens and non-citizens.

Read to find out if your business enterprise qualifies as a minority. We will also discuss how to get certification and its benefits.

Table of Contents

- What is a Minority-Owned Business?

- Benefits of Minority-Owned Businesses

- Access to Government Contracts and Grants

- More Business Partnership Opportunities

- Access to Training Workshops and Business Advisory

- A Better Networking Opportunity

- How to Get Certified as a Minority Business Enterprise

- The National Minority Supplier Development Council (NMSDC)

- Small Business Administration (SBA)

- State and Local Agency Certification

- FAQs

- What is the meaning of minority-owned?

- Do women-owned businesses qualify as MBEs?

- What are the benefits of MBE?

- What are the disadvantages of MBE?

What is a Minority-Owned Business?

A minority-owned business is a company that is at least 51% owned and operated by an individual who is a citizen of the United States. The person’s ethnicity should also be at least 25% Native American, Asian American, African American, Latinx, or Pacific Islander.

For a publicly owned business, at least 51% of the stock should be owned by one or more minority group members.

To get a minority business ownership, the company should meet the following specifications:

- The minority business owner’s net worth should not be more than $4,750,000.

- The minority business owner should not have more than $350,000 in an adjusted gross income for three years.

- The owner should not have assets whose value exceeds $6 million.

- The minority business enterprise owner performs the management and daily operations. (Also, the person takes part in long-term decision-making for the company).

- Minority business principles should be of good character.

- The minority business should have growth potential. Additionally, it should show the ability to succeed in federal and government contracts.

- The business must be a profitable company physically located in the United States or trust territories.

Your business can be certified as a minority-owned business if it meets the above requirements. So, your next task is to prepare the document for the certification process. Let’s discuss the benefits of certified minority-owned businesses before that.

See Related: Best Sustainability Software Programs to Manage Business Continuity

Benefits of Minority-Owned Businesses

Many benefits come from being certified as a minority-owned business. You should not waste any minute if you qualify. You will enjoy the following benefits:

Access to Government Contracts and Grants

Certified minority business enterprises access government contracts and grants. They can compete for set-aside and sole-source contracts if you have a Small Business Administration (SBA) 8(a).

In set-aside contracts, two or more minority-owned businesses can perform a given work or supply needed products. The government usually sets aside some contracts for small businesses. The contracts less than $150,000 are for SMEs certified as minority-owned.

More Business Partnership Opportunities

Many big business enterprises and corporations like to partner with small businesses. A minority-owned business benefits from those opportunities because they can be in the supply chain of those large corporations.

For example, AT&T has partnered with minority, women, and LGBTQ+ businesses in the last five decades. Another example is UPS. This company launched its supplier diversity program in the early 1990s. It has spent billions partnering with small businesses throughout its supply chain.

Access to Training Workshops and Business Advisory

A business certified as a minority accesses training workshops and mentorship programs. These equip small business owners with the management skills they need to grow.

An example of such mentorship programs is 8(a) Mentor-Protégé Programs. Its goal is to offer development help to minority-owned business proteges. Minority business owners learn how to compete and win federal contracts.

Minority business owners can also get financing guidance and trade education.

A Better Networking Opportunity

Minority-owned businesses certified by SBA or NSDC have networking opportunities. These bodies encourage sharing of best business practices and support for one another.

The minority supplier development council offers different trade fairs and networking events. Additionally, there is an exclusive opportunity for small business enterprises. They can apply for grants and scholarships.

See Related: Best Energy Saving in Business

How to Get Certified as a Minority Business Enterprise

A minority-owned business can be certified in many ways, but three methods are the most common. You can achieve certification for your company through the following programs:

- The National Minority Supplier Development Council (NMSDC)

- The Small Business Administration (SBA)

- State and local programs

The requirements for minority-owned businesses to be certified depending on the chosen method. NMSDC, SBA, and others have varying factors they consider. That means you should always seek expert advice before you start the process. Let’s get the details of how to go about it.

The National Minority Supplier Development Council (NMSDC)

NMSDC is arguably the best way for your small business enterprise to achieve minority business ownership. This organization matches certified minority-owned businesses with members within its network. The minority business owners can use this network to meet buyers and service providers.

NMSDC is headquartered in New York City. But it has 24 affiliate regional councils throughout the country. As of today, NMDC has about 1,750 corporate members.

Once certified by NMDC, you will access a network of other small businesses and training programs if you choose it. NMDC offers a working capital loan program that can benefit you as a minority business owner.

What are the requirements for NMSDC?

Any small business enterprise that qualifies as minority-owned can be NMSDC certified. So, what documents do you need to provide? It depends on the type of business. But generally, you will be asked to provide the following:

- Business history certificate.

- Certificate of Incorporation or Articles of Incorporation.

- Stock Certificates and Stock Ledger.

- Proof of U.S. Citizenship, such as a Certificate of Naturalization, Birth Certificate, or U.S. passport.

- Corporate Bank Resolution, including your Bank Signature Card.

- Business Lease Agreement and/or Security Deeds if home-based.

- Proof of general liability insurance, and depending on the type of business, proof of bonding.

- Copies of canceled business checks.

- Bylaws.

- All business ownership agreements.

- Business cards, resume, and copies of drivers’ licenses.

The application process begins with online registration on the NMSDC platform. You should create your account before proceeding with the certification process.

The best approach to minority supplier development council certification is by contacting its nearest regional affiliate. You will get an NMSDC certification specialist to guide you on how to successfully go through the application process.

Minority-owned companies usually complete the certification process in about 90 days. That is because your application needs to be approved by the board and committee members. Upon a successful application, you will get an email notifying you.

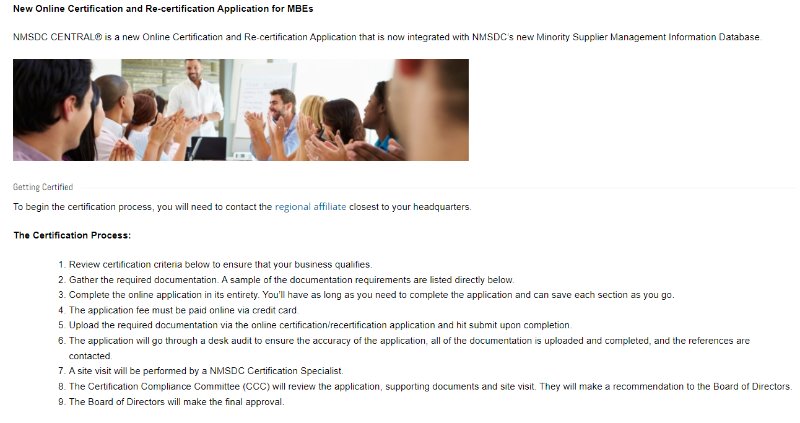

So, what is the application process like? The following steps describe the NMSDC minority-owned business certification process.

- Review of the eligibility requirement.

- Review the online application to ensure you have all of your answers and required documents.

- Begin your application online by clicking the Start MBE Certification. You should have your Tax ID (Employer Identification Number).

- The system automatically assigns an Application ID to your business once you initiate the process.

- Upload scanned files, jpegs, or pdfs. Each copy should include the company name, and the prints should be visible and not falsified.

- The next step is to pay a fee for your application after submitting your documents which must be paid by credit card. The required certification fees depend on the annual revenue of your business. If your small business enterprise gets $1 million or less in revenue annually, the needed certification fee is $350.

- Upon successful document submission and certification fee payment, a Field Auditor will review them and contact you to schedule an on-site visit to the business premise.

- After inspection by the Field Auditor, the completed application is forwarded to the Board Certification Committee for final review and approval.

- Once approved, you get a certification letter and MBE certificate. The processing time varies, but typically, it takes between 45 and 90 days.

Congratulations! You have become a certified minority business owner, and you can enjoy the benefits that come with it.

See Related: Best Farmland REITs for Agriculture Investing

Small Business Administration (SBA)

Choose SBA certification if your main interest is the public sector. It gives you a higher chance of winning federal contracts and partnering with many local government bodies. Also, you access all benefits of the SBA 8(a) Business Development program.

The federal government spends at least 5% of its contracting budget on small businesses with the 8(a) designation. Minority businesses owned by socially or economically disadvantaged individuals qualify for this program.

With an SBA certification, your business can enjoy all the benefits of being certified as a minority-owned business.

See Related: Ways to Start Investing in Small Business

How Do You Apply for the SBA 8(a) Business Development Program?

You have to start the application yourself online through the SBA platform, which can take time and resources.

Fortunately, there are consulting firms out there with experts. You can hire them to help you get your documents ready and increase your chances of success for your SBA 8(a) application. Alternatively, you can use the SBA’s automated preliminary assessment for self-evaluation.

The following is an overview of the requirements for the SBA 8(a) program:

- You should meet the SBA small business standards at the time of application and throughout the 9 years of the program.

- Your small business shouldn’t have participated in the program before.

- Your small business should prove its ability to handle federal contracts successfully.

- You should be a responsible citizen without any outstanding federal financial obligations.

- The minority business owner should have a net worth not exceeding $250,000 and meet the minority business requirements stated earlier.

On the positive side, the SBA 8(a) Program application fee is free. It will only cost your time for the application (and maybe the cost of hiring a consultant). If you are successful, you will get an email confirming your approval within 90 days of the application.

See Related: How to Become an Impact Investor [Step-by-Step Guide]

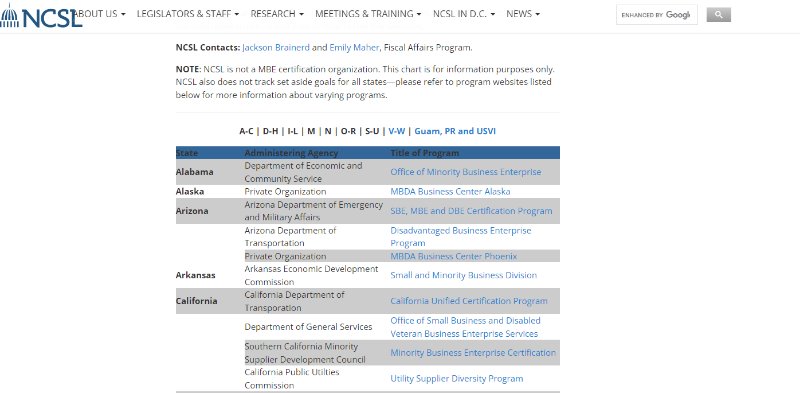

State and Local Agency Certification

Like other certification processes, the requirement for state and local agency certification is that 51% of the company should be owned by a minority group member.

Most states and local agencies provide minority-owned business programs. You can check with your state to know the ones available for your business.

Many state-level certification programs exist. You can look for them on your municipality’s online platform. Navigate to the economic development or certification section to view all listed programs for minority-owned businesses.

There is a long list of state and local certification programs on the National Conference of State Legislation website. Here, you can browse the content by state and see what applies to your business. You will also find more information on minority business development.

FAQs

What is the meaning of minority-owned?

Minority-owned is an adjective used in the United States to describe businesses owned by a minority member or a group whose members are of a different race, culture, or religion.

These SMEs are spread throughout the country and certified to access financing services and other benefits.

Do women-owned businesses qualify as MBEs?

Yes. Women-owned businesses can also qualify as MBEs if they meet the requirements for minority-owned businesses. However, NMSDC does not offer any certification specific to women.

That is conducted by the Women’s Business Enterprise National Council (WBENC), and the benefits are similar. They can access business training, business loans, federal contracts, etc.

What are the benefits of MBE?

MBE certification has many benefits, including exclusive access to top corporate purchasing agents, a searchable supplier database, premium networking events, etc. Small businesses are certified by different corporations to unlock these benefits.

What are the disadvantages of MBE?

MBEs give managers the power to make important decisions. That can demoralize employees who may feel no one cares about their interests. It also takes time for issues facing employees to reach the management.

Related Resources

- Best Business Loans for Solar Energy

- Best Sustainable Business Examples to Follow

- How to Start Investing in Women-Owned Business

Kyle Kroeger, esteemed Purdue University alum and accomplished finance professional, brings a decade of invaluable experience from diverse finance roles in both small and large firms. An astute investor himself, Kyle adeptly navigates the spheres of corporate and client-side finance, always guiding with a principal investor’s sharp acumen.

Hailing from a lineage of industrious Midwestern entrepreneurs and creatives, his business instincts are deeply ingrained. This background fuels his entrepreneurial spirit and underpins his commitment to responsible investment. As the Founder and Owner of The Impact Investor, Kyle fervently advocates for increased awareness of ethically invested funds, empowering individuals to make judicious investment decisions.

Striving to marry financial prudence with positive societal impact, Kyle imparts practical strategies for saving and investing, underlined by a robust ethos of conscientious capitalism. His ambition transcends personal gain, aiming instead to spark transformative global change through the power of responsible investment.

When not immersed in the world of finance, he’s continually captivated by the cultural richness of new cities, relishing the opportunity to learn from diverse societies. This passion for travel is eloquently documented on his site, ViaTravelers.com, where you can delve into his unique experiences via his author profile.