Many digital investment management platforms are launching every day, but before you toss your money at the new thing on the internet, read our Axos Invest review instead.

The surge of new investing platforms has been increasing steadily for the last several years. With more younger people looking to invest, they are interested in straightforward options that allow them to manage their money the way they choose. Of course, affordability is another factor in the rise of online investing.

Robo-advisors are much more affordable than paying high fees to a live broker or finance guru. If you are new to investing or simply want to simplify your investing process, heading online is a great way to go about it.

Not only are Robo-advisors easy to work with, but they also offer a no-hassle way to diversify or build an ESG friendly portfolio.

In our Axos Invest review, we will cover the sophisticated yet oddly traditional way that online investing through the platform can help you grow your investments.

With this goal-based approach, not only can you manage your money more effectively, but you can also get valuable advice that will help you reach financial independence and much more.

Table of Contents

What is Axos Invest?

Axos Invest is an automated investment platform that previously went by the name Wisebanyan.

Our Axos Invest review will what the platform is and how it can help grow your portfolio. This investment platform helps users to tailor their portfolios in a way that helps them to reach both their long-term and their short-term goals.

In all, Axos Invest pulls from more than 1,400 EFTs that are listed as being affordable for all tiers. With this platform, investing is simplified via the managed portfolio and online option.

Instead of paying high fees and actively participating in trading, you can invest in ESG ETFs that match your values with minimal fees.

While most robo-advisors offer the same basic range of services, our Axos Invest review will show you what sets them apart. For one, if you are looking to diversify in a streamlined manner, Axos is worth a look. The platform is set up for those who are not used to investing.

The easy-to-understand interface, clear directions, and detailed EFT information make it easy to choose companies to add to your portfolio that matches your values and those that will help you reach your investment goals.

It is also great for those who prefer the hands-off method of building their portfolio, with lower fees than average. With a small minimum of only $500 to start an account, Axos Invest is set to become one of the most popular robo-advisors on the internet.

See Related: Ways to Start Investing in Vertical Farming

All About How Axos Invest Works

Axon Invest operates in simple risk analysis and personality profile method. The system uses an AI to gather information about your investment goals, risk thresholds, and even your sustainability targets.

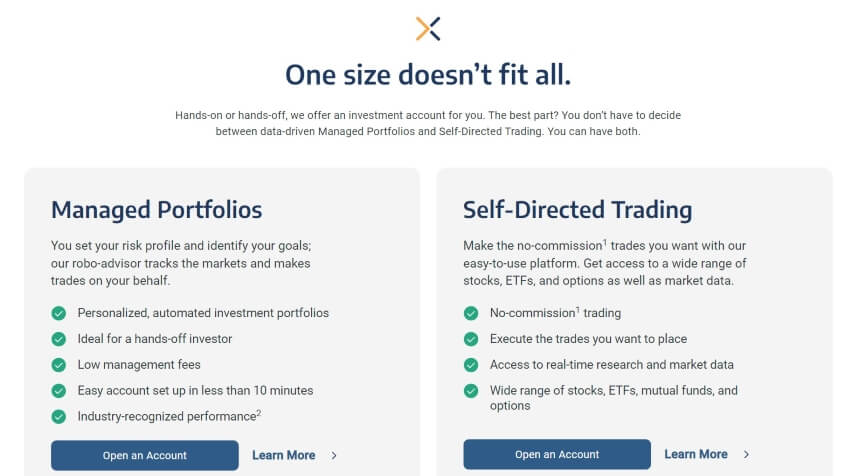

Axos Invest has three distinct main product offerings:

- Self-Directed Accounts

- Automated

- Retirement Accounts

It creates a profile that is then used to build a custom portfolio on your behalf.

There are no minimum balances, so this investment brokerage and advisor will work within your investing budget to create wealth that will allow you to secure your future. Your investment dollars will be used on ETFs, and then your dividends will be managed and rebalanced automatically.

Basically, all of the complicated parts of investing without the hassle of actually having to do it all on your own. It also helps you protect your returns from taxing with the tax protection option, and there is an option for fully automated services so you can passively watch your investments grow.

See Related: Best ESG Stocks to Invest in Today

How to Sign up For Axos Invest

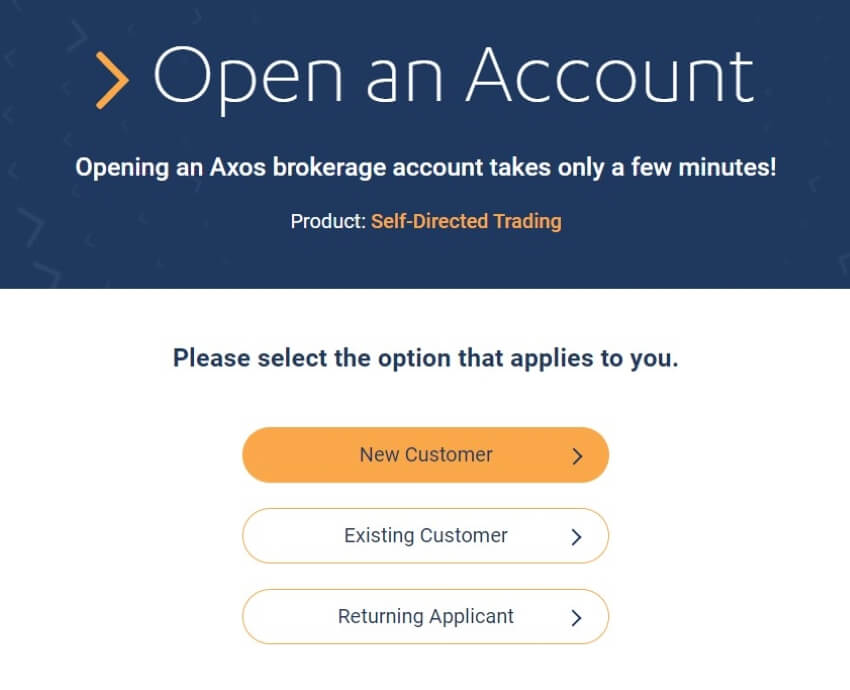

Our Axos Invest review would not be complete without letting you know how to sign up to get started on building your portfolio.

Getting started on the platform is pretty simple. All you have to do is navigate to the home page and click the sign-up button. You will be asked several questions regarding your investing habits and goals.

These questions are intended to help nail down your long and short-term financial goals in addition to determining your risk tolerance level. Your answers are confidential, so make sure to answer them honestly so that your profile will better reflect your needs.

Also, your risk score will vary between one and 10, with 10 being the highest risk tolerance.

Your answers directly affect what score you are assigned, and as a result, which investments will be made on your behalf. Of course, you can adjust your risk score manually along with any other financial-related settings after your account has been set up.

You will also be asked some identification questions, and you will need to provide basic information such as your social security number, address, and work details.

There are many corporate bonds in the investment selection, which is riskier than other types due to the risk of inflation and rate hikes by the fed.

Make sure to keep this in mind when checking out your risk score, as the higher your score is, the more of these particular bonds are likely to be added to your portfolio.

Once your score is finalized, you will be asked which account you would like to open. Then, you will need to supply your banking information and make your first deposit.

You will also be prompted to set up automatic deposits to keep your investment account funded and growing even while you are not online.

Unlike other platforms, it takes about two weeks for your account to be verified and funded.

However, during the wait, the will be hard at work creating a profile that matches your assigned preferences.

See Related: How to Start Investing in Women

Is Axos Invest Legit?

Axos Invest is a legitimate investment tool. The company is licensed and registered to conduct financial transactions both locally and internationally.

The business falls under the regulations of the SEC, among others. Axos Invest, like most robo-advisors, has joined FINRA (Financial Industry Regulatory Authority).

Though this is a self-regulatory organization, it allows investors to check the legitimacy and performance records so that a human advisor can be cross-referenced.

As far as the SEC is concerned, robo-advisors retain the same legal status and responsibilities as traditional human investment advisors.

They must be legally registered and in good standing with the SEC to provide services to the public.

They are also subject to the same rules, regulations, and securities laws as traditional investment brokers.

Consumers can look up Axos Invest on BrokerCheck to find more detailed information regarding their services and status with the SEC.

It is important to note that any assets held or managed by Axos Invest on your behalf are not FDIC insured since they are investment funds and not traditional deposits.

See Related: Vinovest Review: Is It Legit & Worth It?

Axos Invest Pros

When you are investing, your goal is generally to create wealth. Along these lines, Axos Invest helps you to reach your goal by offering low-cost management fees via their robo-advisor.

Their fees are a low 0.24 % which is much lower than live portfolio management costs. You can also customize your portfolio during or after the initial account setup.

While creating an account, the Axos Invest robo-advisor will ask a few questions that help to create a risk score and determine the type of investments you are likely to prefer.

All of the suggestions will be exchange-traded funds, and you have the option of changing your risk preferences at any time.

Like most robo-advisors, the expense ratios have an average of 0.12% and feature U.S. government and corporate bonds, local and global emerging market equities, short-term high-yield bonds, real estate investment trusts, and Treasury Inflation-Protected Securities.

There is a no-cost Plus feature that allows you to remove or add over 30 different types of investments that are sector separated.

This is a great option for investors looking to make socially minded investments and those who prefer to park their money in specific industries.

The automated investment feature is a great way for clients to grow their balance without actively searching out good opportunities.

Setting goals and having the account work for you is one of the best features on the platform. It is also worth mentioning that Axos also offers tax-loss harvesting will all of their account tiers.

See Related: What are Social Returns on Investment?

Axos Invest Cons

Axos has grown a lot in the years since it was launched. It has gained some positive upgrades but also has some important downsides to consider.

In the past, investors only needed to deposit a minimum of $1 to create an account. This made it accessible for all levels of investors regardless of their financial ability.

The minimums have now been raised to $500, which is still not as high as others in the same field but still prices out a large segment of investors.

Considering that many platforms have no minimums, it seems like the higher requirements are a step back from how they used to operate.

Some technical glitches hit the platform that caused some miscommunication between platform accounts and financial institutions.

Axos claimed to refund and fees incurred and fixed the problem, but such a big mishap is concerning.

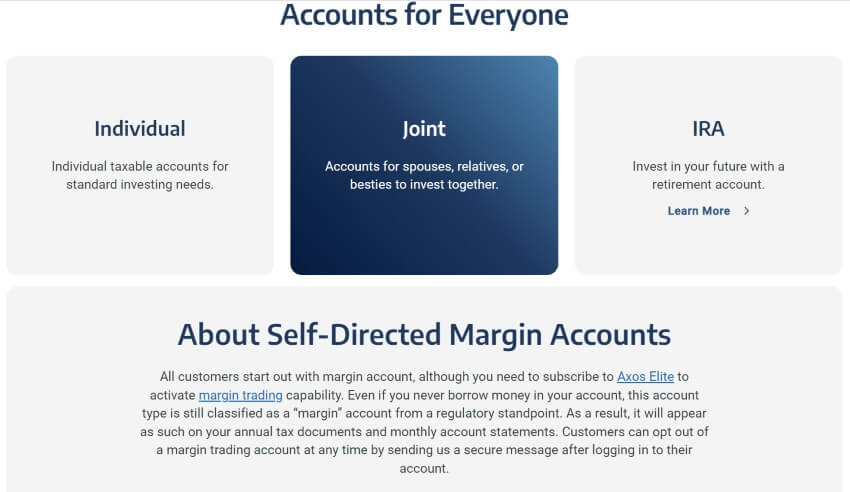

Another issue we noted is that only two account types are available; traditional or individual tax accounts. So, if you have a spouse or even a partner that you typically invest with, you won’t be able to create a joint taxable account. Other platforms allow you to do so, but not Axos Invest.

Also, you are not able to create trust accounts or even accounts for minors.

See Related: How to Invest in Wind Energy

Axos Invest Fees

Axos Invest has a $500 minimum investment and charges an account management fee.

0.24% annually regardless of account level.

On par, the investment expense ratio is an average of 0.12%. There is a straight $75 fee for transferring money out of an account, a $10 closing fee for IRAs, and a $30 fee for any returned checks.

There is also a $25 fee if you need an outgoing wire sent to your account or any other account.

See Related: Best ESG Funds to Invest for Impact

Axos Invest Performance Ratings

Axos Invest is noteworthy for a few reasons, some of which you already noticed in our Axos Invest review above.

The high level of customization is what really sets this platform apart from other robo-advisors.

With 32 different investment types that you can remove or add to your portfolio, this is one of the best platforms around for creating unique investment portfolios that actually match your values.

Another thing the platform has going for is the low account management fees, much lower than other companies in the same space.

- Ease-of-Use – 5

- Features – 4

- Customer Service – 3

- Value for Money – 3

For those looking for low-cost, highly customizable portfolios, and goals-based tools, this is certainly the platform for you.

The low minimums are a draw but keep in mind there are limited account types to choose from.

If you are an investment newbie, Axos Invest is worth your time.

See Related: What is a Quadruple Bottom Line?

Axos Invest Referral

ESG investing is all about making smart choices and choosing stocks of companies that also make smart choices.

Robo-advisors are a great way to get started in ESG investments without having to pay high fees for a live advisor.

That being said, if you are looking for guidance that is based on your personal ESG targets, Axos Invest is a great option.

This service is low-cost and will allow you to choose your own ESG investments easily. You can also allow the service to make the choices on your behalf if you prefer.

Related Reviews

- Wealthfront SRI Review

- Personal Capital SRI Review

- Wunder Capital Review

- VFTAX Review

- Arcadia Power Review

Related Resources

- Examples of the Collective Impact Model

- Best Vanguard ESG Funds

- Benefit Corporation vs. B Corp

- Best Real Estate Investing Websites

Kyle Kroeger, esteemed Purdue University alum and accomplished finance professional, brings a decade of invaluable experience from diverse finance roles in both small and large firms. An astute investor himself, Kyle adeptly navigates the spheres of corporate and client-side finance, always guiding with a principal investor’s sharp acumen.

Hailing from a lineage of industrious Midwestern entrepreneurs and creatives, his business instincts are deeply ingrained. This background fuels his entrepreneurial spirit and underpins his commitment to responsible investment. As the Founder and Owner of The Impact Investor, Kyle fervently advocates for increased awareness of ethically invested funds, empowering individuals to make judicious investment decisions.

Striving to marry financial prudence with positive societal impact, Kyle imparts practical strategies for saving and investing, underlined by a robust ethos of conscientious capitalism. His ambition transcends personal gain, aiming instead to spark transformative global change through the power of responsible investment.

When not immersed in the world of finance, he’s continually captivated by the cultural richness of new cities, relishing the opportunity to learn from diverse societies. This passion for travel is eloquently documented on his site, ViaTravelers.com, where you can delve into his unique experiences via his author profile.