Investors today are choosing stocks and investments that align with their values – not just their wallets.

Instead of selling their soul to make a profit, investors find ways to invest in something they strongly believe in consciously. This way, individuals can feel better about their investment topic while simultaneously making a profit.

So, what socially responsible stocks should you look for? The type of stock you may invest in could differ from your friend’s or neighbor’s investments, so don’t depend too much on those around you.

Instead, research to find socially responsible companies that align with your values. This process can take time, but the end product is worth it.

Table of Contents

- Top 15 Stocks For Socially Responsible Investing

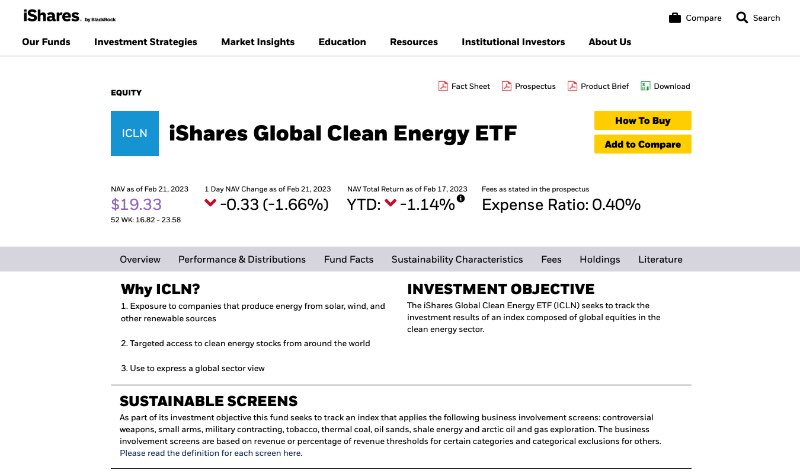

- 1. iShares Global Clean Energy ETF: Best Investment for Clean Energy

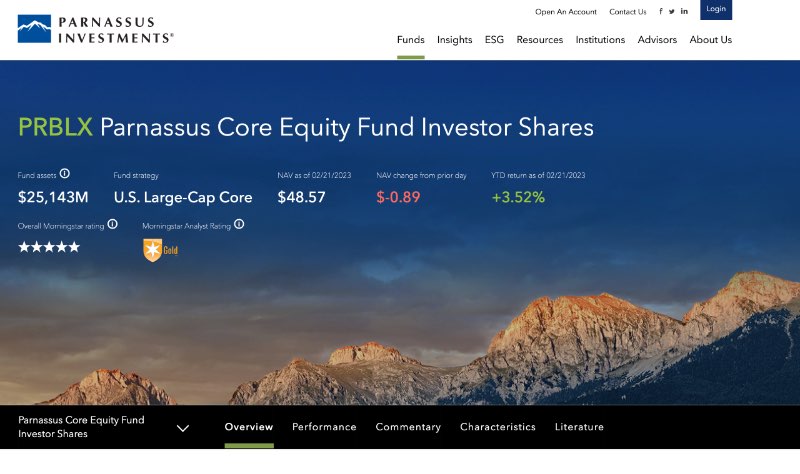

- 2. Parnassus Core Equity Fund Investor: Best Investment for Risk Management

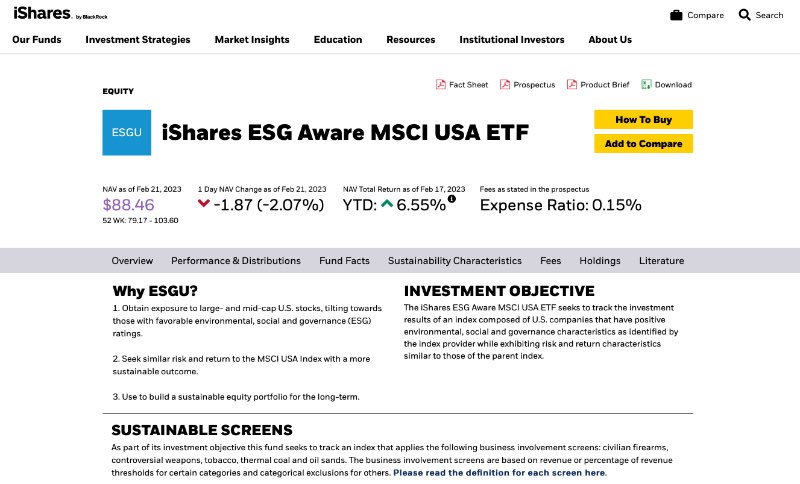

- 3. iShares ESG MSCI USA ETF: Best Investment for Businesses Who Need a Short-Term Boost

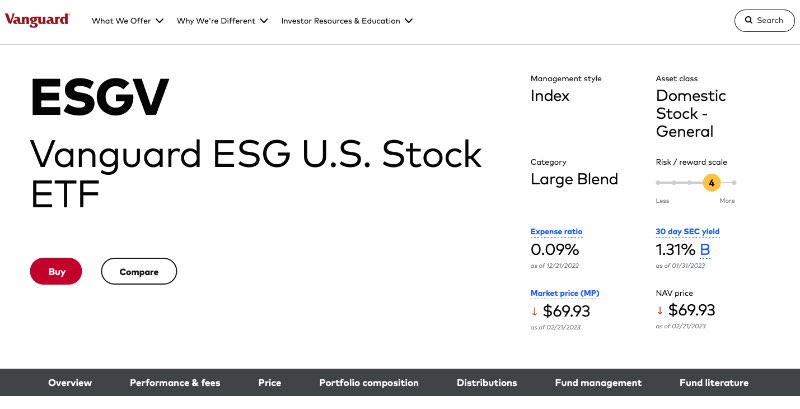

- 4. Vanguard ESG U.S. Stock ETF: Best Investment for Meeting Corporate Criteria

- 5. PowerShares Global X CleanTech ETF Portfolio: Best Investment for Environmentally-Friendly Nutrition

- 6. SPDR S&P 500 Fossil Fuel Reserves Free ETF: Best Investment For Fossil Fuel Exclusion

- 7. Pax Ellevate Global Women’s Leadership Fund: Best Investment For Women’s Rights

- 8. Nuveen ESG Small-Cap ETF Fund: Best Investment To Help Small Businesses

- 9. First Trust Water ETF: Best Investment For Clean Water

- 10. Serenity Shares Global Impact ETF: Best Investment For Social Impact

- 11. SPDR SSGA Gender Diversity Index ETF: Best Investment For Female Empowerment

- 12. Organics ETF: Best Investment for Organic Products

- 13. Gilead Sciences Inc: Best Investment for Medical Research

- 14. QUALCOMM Incorporated (QCOM): Best Investment in Wireless Technology and Communications

- 15. AllianceBernstein Sustainable Global Thematic Fund (ATEYX): Best Investment for Health, Climate, and Empowerment

- The Best Apps for Socially Responsible Investing

- 1. M1 Finance

- 2. Empower (Formerly Personal Capital)

- 3. Betterment

Top 15 Stocks For Socially Responsible Investing

We have looked at various categories to understand the best socially responsible stocks available for conscious individuals. It includes environmentally-focused companies, social warriors, and governmental organizations that can embrace common personal values.

We analyzed various websites for the best ETFs for specific social and environmental causes, such as women’s rights, reducing fossil fuel intake, and clean energy.

By reading reports and analyses on the top ESG funds for people who want to align their investments with their governmental, social, and environmental beliefs, we narrowed the extensive list to our top choices.

Let’s list the top fifteen socially responsible exchange-traded funds to consider for your next significant investment.

See Related: Healthpeak Properties, Inc. ESG Profile (PEAK): Is It Sustainable?

iShares Global Clean Energy ETF, also known as ICLN, is a climate and environmentally-focused business that reduces carbon emissions harming the air quality and environment. This fund directs all of its ‘energy’ into clean energy.

The socially responsible fund is the top choice for eco-conscious individuals who invest in clean energy, such as solar power and wind turbines. Also, other energy-producing endeavors exclude harvesting crude oils and gasses that pollute the environment.

As we have seen in recent years, the focus on environmentally-friendly products and business practices has skyrocketed. Businesses are now using paper cups, finding new power sources, and investing in renewable energy.

Consider jumping on the stock market to do something good for the environment and the planet by investing in the iShares Global Clean Energy ETF.

ICLN is an intelligent voice for socially responsible investors who want to help the world with their investments. This business protects and invests in other industries with like-minded thoughts – such as smaller companies producing solar energy, wind energy, and renewable resources.

Furthermore, the firm earns approximately half its incoming revenue from products or services that meet the UN’s Sustainable Development plan needs.

According to the YTD Lipper Ranking, this fund is in the 70th percentile, earning the highest ranking possible in the ‘Expense’ category and a favorable 3 out of 5 ranking in the ‘Total Returns,’ ‘Consistent Return,’ and ‘Tax Efficiency’ categories.

Therefore, this high-ranking stock is a good investment for long-term financial gain – and a feel-good conscience.

Look into the S&P Global Clean Energy Index to find 30 clean energy companies worldwide. Comparing companies utilizing the S&P Global Clean Energy Index and others solely focusing on the stock exchange can help investors make financial decisions.

Pros:

- iShares Global Clean Energy ETF earns a 43.59% one-year price return

- iShares is the largest ETF with over $6 billion in assets

- Earns an A for the MSCI ESG score

Cons:

- Features a low yield percentage of 1.03%

See Related: Ethical Dividend Stocks to Invest in Today

2. Parnassus Core Equity Fund Investor: Best Investment for Risk Management

The second option for investing is Parnassus Core Equity Fund Investor. This publicly traded company believes that teaching people how to manage risks, understand probable outcomes, and handle controversies is essential to making smart financial decisions for their future.

By partnering with data analysis, they help provide businesses with hyper-focused long-term goals and qualified higher-level staff.

Not to mention, this investor has had tremendous success in the past couple of years. Their specific fund, the Parnassus Core Equity Fund Investor, has churned out an impressive 20.3% annual return in the past three years. And it is a top contender regarding the best ETFs for socially conscious investors.

If you are an established business looking for competitive advantages among similar companies in your industry, consider using the Parnassus Mid Cap Fund Investor from the same company.

Pros:

- Averages a 1-year annual return of 27.55% and 26.4% in 3 years

- Feature a high level of return according to the Morningstar Snapshot

- Earned a 5-star review by the Morningstar Analyst Rating

- Earned a high sustainability rating

- Features a low corporate sustainability risk

- The carbon risk score and fossil fuel involvement % are both meager

Cons:

- According to the Morningstar Snapshot, the risk of investments in this category is high.

See Related: Best EV Charging Station Stocks

The iShares ESG MSCI USA ETF fund is an excellent investment for companies dealing with the fallout of severe business controversies that may have tarnished their reputation in the industry.

This ESG fund can help corporations increase their intangible value assessment by determining the present risks to the company with its market.

Companies who want to get ahead of the curve- and avoid any long-term controversies or unsafe investments – should use this ESG Fund to analyze the presence of risk exposure within the industry.

By realizing the most common risks that can occur, such as data security, client satisfaction, or company scandals, businesses can reduce the prevalence of any business-threatened issues. This USA ETF fund is a short-term investment that can help companies to get out of an immediate rut.

Although this option is not ideal for long-term investments to secure finances over multiple months or years, the ESG fund can help companies increase their standing in their respective industry.

Pros:

- The low fee is much more cost-effective

- Earned the Morningstar Analyst Rating of Silver

- Rated 5/5 stars by Morningstar

- Features a competitive 0.15% expense ratio

- Sustainable income and low risk

- Contributes to a sustainable equity portfolio

Cons:

- Not the best for investors who want international investments

- Low yield percentage of 1.06%

See related: Important Socially Responsible Investing Pros and Cons

4. Vanguard ESG U.S. Stock ETF: Best Investment for Meeting Corporate Criteria

Another beneficial choice for socially responsible funds is the Vanguard ESG U.S. Stock ETF or the ESGV.

This outstanding stock is morally obligated to meet specific social, environmental, and governmental standards, providing a high-performance outcome and low expense ratio.

The ESGV fund holds over 1,400 stocks in various companies across the globe, including some big-name corporations to increase its standing in the industry, such as Apple and Amazon.

This large-blend ETF scored #33 in the ‘Large Blend’ category on Money US News compared to similar stocks. Earning an ‘Excellent’ in the Costs category, ‘Excellent’ in the Tracking Error category, and ‘Good’ in the Holdings Diversity category, this large blend ETF is one of the top-ranked passively managed funds for socially conscious investors.

If you love Vanguard but want to try your luck in a different investment portfolio, consider using the Vanguard FTSE Social Index Fund Admiral.

This fund is inexpensive, top-rated, and reduces any risk of investing in controversial or risky industries.

With a $10k initial investment, this social index fund can be a good choice for individuals who want to invest in a fund that makes SRI exclusions (socially responsible stocks investments).

Pros:

- Earned an 81% ranking according to the YTD Lipper Ranking

- Excludes companies to reduce the carbon usage of the portfolio

- Excludes individual stocks violating labor and human rights

- Screened for ESG criteria

- Earned a 5/5 Morningstar Analyst Rating

Cons:

- A client may not want to risk investing in an ESG ETF.

- Higher risk potential

- Features a low 12-month yield of 0.95%

See Related: What Are Conscious Capitalists? Definition & Key Principles

PowerShares Global X CleanTech ETF Portfolio is a fund that provides environmentally-friendly agriculture and nutrition. It helps alleviate the effects of harmful farming practices and inadequate nutrition.

After its inception in 2006 and over 15 years of experience, this socially responsible portfolio suits those wary about investing in risky companies. This mid-growth fund focuses on energy – specifically cleantech energy – in various regions worldwide.

PowerShares invests most of its money in the industrial, technology, and essential materials sectors. It focuses on helping the environment by utilizing alternative farming and energy practices.

Pros:

- The projected 5-year growth of the business is very high

- Features a lower carbon risk score of 23 out of 100

- High growth potential

- Global exposure in many industries

- Uses ESG guidelines

Cons:

- The fund has a high expense ratio of 0.65%

- High volatility and liquidity during the 5-year projection

- 84.8% fossil fuel involvement

- Increased risk for the corporate sustainability score

See Related: Worst ESG Companies | Stocks to Avoid

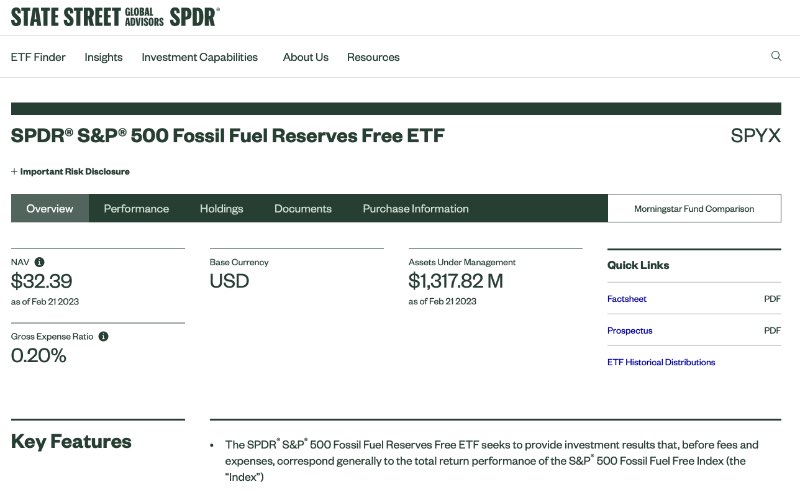

6. SPDR S&P 500 Fossil Fuel Reserves Free ETF: Best Investment For Fossil Fuel Exclusion

By now, it is likely common knowledge that fossil fuels are ‘bad.’ Individuals strive to use clean and green practices to power their cars, heat their houses, and run their businesses. So why are we talking about fossil fuels?

By using the SPDR S&P 500 Fossil Fuel Reserves Free ETF, individuals can invest in energy-clean companies by excluding fossil fuel reserve-based businesses.

This ETF fund specifically addresses businesses that use thermal coal reserves, non-metallurgical reserves, chemical byproducts, conventional oil, natural gas reserves, shale gas reserves, and oil and gas reserves – and removes them from any investment portfolio.

With an estimated 3.5-year growth of over 18% and almost 500 holders, these SRI mutual funds could be an excellent investment for conscious individuals. After extensive analysis by FactSet, First Call, and Reuters, results show this fund will grow in the upcoming years.

As an added plus, Morningstar has awarded this ETF fund with 5 out of 5 stars and three sustainability awards.

Pros:

- The 1-year return of the fund is an impressive 23.78

- Features a low expense ratio of 0.20%

- Earned a 5/5 in the YTD Lipper Ranking

- The value of the stock has increased in the past year consistently

- Earned a 5/5 in the Morningstar Analyst Rating

- Low carbon risk score

- Low fossil fuel involvement %

Cons:

- Currently has a YTD return of -2.50%

- Low SEC yield of 1%

- Low sustainability rating of ⅗

- Average corporate sustainability score

See Related: How Much is a Wind Turbine? Here’s What to Know

7. Pax Ellevate Global Women’s Leadership Fund: Best Investment For Women’s Rights

Gender equality is one of the most significant issues the world faces. Across the globe, women are fighting for rights such as earning equal pay, speaking out against injustices, holding jobs, divorcing a partner, and voting.

Even though women’s rights vary widely based on county and culture, investing in a socially conscious ETF fund that highlights gender diversity is essential to bring light to the importance of gender equality, diversity in the workplace, and including women in the conversation.

Investing in Pax Ellevate Global Women’s Leadership Mutual Fund is one of the best opportunities for individuals who want to put their money into gender-diverse companies that provide equality, opportunity, and fair treatment to all employees.

This Women’s Leadership Fund uses the Impax Global Women’s Leadership Index to analyze over 1,500 companies to scan for criteria, such as women in positions of power, gender pay data, and employee satisfaction levels. This workplace data provides Pax Ellevate with the necessary information to highlight and work with gender-diverse businesses.

This ETF fund works with high-ranking and high-earning companies like Microsoft and Estee Lauder. They also focus on providing the resources necessary to increase innovation and employee retention rates.

Pros:

- The fee level is below average

- Increased returns

- 100% corporate sustainability contribution

- Very low carbon risk score and fossil fuel involvement %

Cons:

- 3 out of 5 Morningstar rating for projected returns

See Related: Best 5G Stocks to Invest in Today

8. Nuveen ESG Small-Cap ETF Fund: Best Investment To Help Small Businesses

Unfortunately, small businesses were hit extremely hard during the pandemic. More so than your big-brother corporation down the street from your house.

To help small businesses succeed, many people began ordering takeout food from their local corner restaurants. They pick up coffee through a takeaway window on daily walks. And order products online to keep them in business.

Being socially responsible means helping people in the community succeed. Instead of giving your hard-earned money to massive corporations, such as Walmart. Shop at small businesses that need your help to stay afloat.

Make socially responsible investments in the Nuveen ESG Small-Cap ETF fund. And you can help small-cap companies withstand the tough times of economic recession. And bounce back after slow periods of their business.

This ETF fund uses the Small-Cap Index to invest in small businesses, such as technology companies, industrial companies, and numerous other sectors. It helps spread the wealth of the investments.

And don’t worry – this ETF fund avoids fossil fuel businesses and deforestation companies that harm the environment. We recommend investing in this ETF fund to feel good about helping those around you while simultaneously helping the environment.

Nuveen uses the As You Sow environmental nonprofit to avoid investing in deforestation companies. Altering the forest cover and increasing deforestation in recent years has negatively impacted the environment, changing the climate’s temperature and harming businesses.

Pros:

- Earns a 5/5 Morningstar Analyst Rating

- Features a low expense ratio of 0.3%

- Increased from 10,000 to 19,000 YTD in one year

- Features a 3-year total return is 19.26%.

- 100% corporate sustainability contribution

- 5/5 sustainability rating according to Morningstar

Cons:

- Contains a 14% unallocated risk according to the ESG pillars

- Low SEC yield of 1%

- High volatility and liquidity ranking

See related: Best Vanguard ESG Funds

9. First Trust Water ETF: Best Investment For Clean Water

A few high-ranking ETFs focus on providing clean water to people around the globe. One of the best choices is the First Trust Water ETF. It prioritizes US-based companies in the wastewater and potable water industries.

If you are an avid hiker, enjoy kayaking, or love camping with the family on the weekend, this ETF is socially responsible for helping clear the flowing rivers.

Not to mention, this ETF only invests in businesses that are clean-water and environmentally friendly focused. It provides monetary assistance to infrastructure, purification, and filtration companies.

Lastly, the FEW uses the USE Clean Water Index to determine which businesses they should focus on. The index analyzes stocks in the wastewater and potable water industry and eliminates any options that do not meet the requirements of sustainable revenue.

If you are looking for a mid-blend ETF to invest in (instead of a mid-growth fund), consider looking at the Guggenheim S&P Global Water Index ETF. This ETF gathers its data from the reputable S&P Global Water Index. It analyzes 50 water companies centered in the US, Asia, and Europe to improve water conditions around the globe.

Pros:

- Earned a 5/5 Morningstar Analyst Rating

- 6th percentile for a 3-year projection

- Earned a low score on the ‘risk’ category

- Earned a High score on the ‘return’ category for the 3-year projection

- Increasing net asset value

Cons:

- 2 out of 5 stars for the sustainability rating, according to Morningstar

See Related: Best ESG Rating Agencies – Who Gets to Grade?

For investors who want to focus specifically on the individual needs of people in their society, whether it be social requirements, planetary needs, or governmental changes, consider investing in the Serenity Shares Global Impact ETF. This passive investment fund browses hundreds of US-based companies to help address communities’ societal and social needs.

This ETF has successfully identified what needs to be changed throughout numerous societies to improve the world using the UN Sustainable Development Goals.

Serenity Shares has determined the products and services essential to a healthy and happy society. And it focuses on providing these possible services to people around the globe.

Serenity Shares uses the calculation methodology to ensure no one business takes over the entire index. By identifying the areas around the world where society can improve, this fund focuses on providing more of what the world needs – like clean water, environmental action, and accessible health services.

Pros:

- Earned a 4 out of 5 for the Morningstar Analyst Rating

- Increased from 12,000 to 22,000 YTD since early 2020

- Projected 3-year projected return of over 18.80%

Cons:

- High expense ratio (0.49%)

- The total return is -7.51% for the one-year projection

See Related: Best ESG Target Date Funds

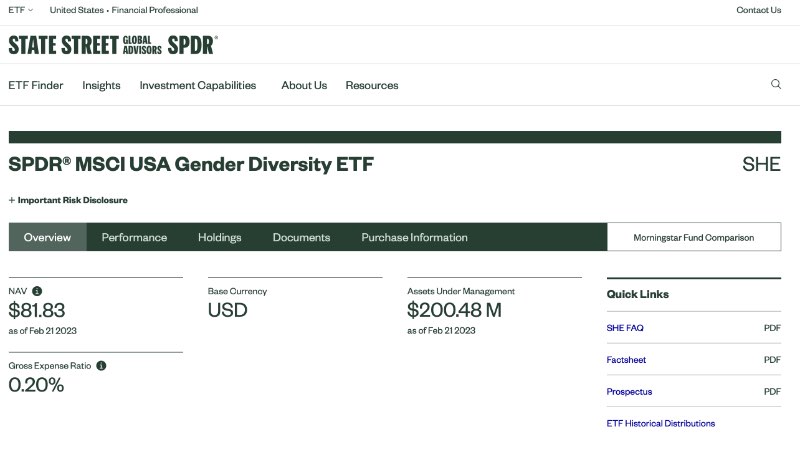

11. SPDR SSGA Gender Diversity Index ETF: Best Investment For Female Empowerment

The SPDR SSGA Gender Diversity Index ETF is a large-blend investment fund with one goal – female empowerment. In a male-dominated world, this ‘girl boss’ fund is just what socially conscious individuals seek.

Featuring companies that pride themselves on gender diversity and women in senior management positions, the SHE investment fund only spends its time and money on businesses with similar interests in helping women progress in the workplace.

While this fund is a fantastic way to support female empowerment, there are a few things to be aware of. For example, it has a low score for total returns and consistent returns in the YTD Lipper Ranking and a low SEC yield of 0.91%

Pros:

- Low dividend of $0.32

- Consistent growth from February 2021-December 2021

- Excellent ‘Costs’ and ‘Tracing Error’ scores

- In the ‘Best Fit’ list of Large Blend ETFs

- 4 out of 5 sustainability rating

- Low carbon risk score and fossil fuel involvement %

Cons:

- Scorecard of 5.8 out of 10, according to Money US News

- Above-average risk for three and 5-year projection

See related: Why is Socially Responsible Investing Important?

12. Organics ETF: Best Investment for Organic Products

This organic-focused fund is calling your name for our vegans and nature lovers. Organics ETF focuses on helping all-natural grocers. And food production companies churn out good organic food for our bodies and the environment.

Organics ETF prides itself on being a fund that seeks to aid specific companies that can help produce organic items for everyday use, such as organic food, cosmetics, or packaging.

With a reach of 25 companies spanning four continents, Organics ETF has high-ranking partners, such as United Natural Foods, Wessanen, and L’Occitane International.

Is there a benefit to investing in organic products and companies? Yes! The mixture of stable and high-risk companies has a higher chance of long-term returns vs. other fund options.

Pros:

- Excellent investment for helping global nutrition.

- Invests > 80% of its assets into Solactive Organics Index businesses

- Holds 25 companies on four continents

- YTD return of 37%

- Cumulative return of almost 33% since inception

- Reasonable 0.50% expense ratio

Cons:

- The value of the stock has decreased over time

- Small asset base

See Related: Best Paying Jobs in Energy

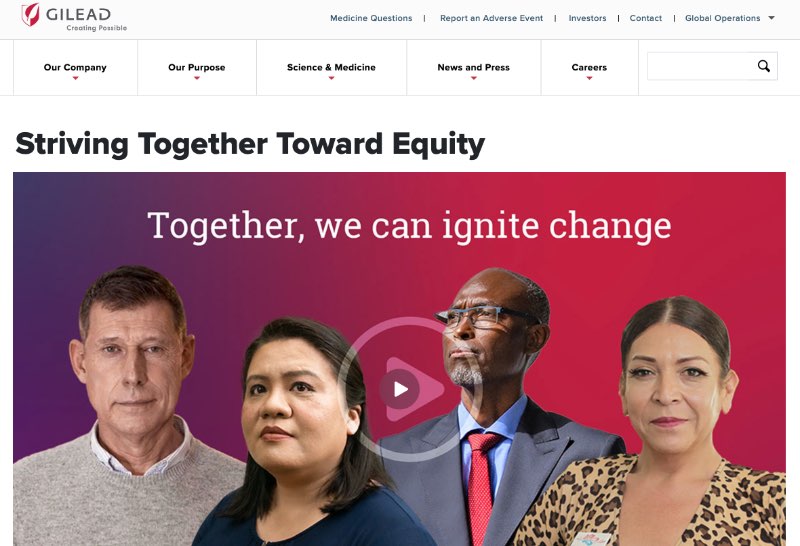

13. Gilead Sciences Inc: Best Investment for Medical Research

Gilead Sciences Inc is a medical research and development company that aims to further global health standards to provide accessible and high-quality healthcare to every single person.

Focusing on people who may not have healthcare access or the money to pay for private care, Gilead Science wants to help everyone get the care they deserve.

By coming up with new therapies and medications to help individuals suffering from long-term illnesses and diseases, such as HIV, hepatitis B, pulmonary disease, and cancer, this business is trying to make necessary medications more accessible.

Pros:

- Patient Assistance Programs offer free medication to those in need

- Working to make medicine more accessible

- Ongoing research to revolutionize the medical field

Cons:

- Moderate controversy level

- Medium ESG risk rating

See Related: How to Invest in Stocks: A Comprehensive Guide for 2023

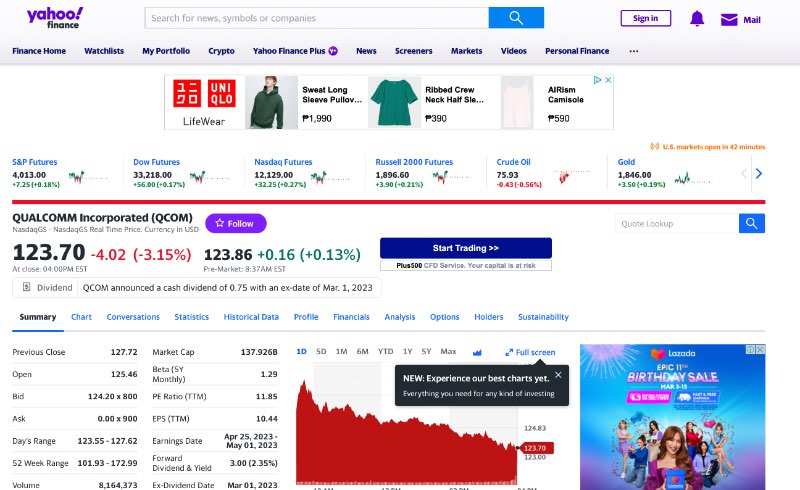

14. QUALCOMM Incorporated (QCOM): Best Investment in Wireless Technology and Communications

Qualcomm (QCOM) is a leading technology company specializing in wireless telecommunications products and services. With its shares in 44 socially responsible fund portfolios and the broadest ownership of any stock, according to Morningstar, Qualcomm is a popular choice for socially responsible investors.

The company’s appeal stems from its role in the spread of wireless communications worldwide. And socially responsible investors are drawn to the considerable boost in human knowledge and advancement driven by wireless communications around the globe.

The company’s contributions to the wireless industry have led to significant advancements in human knowledge and communication, contributing to global progress.

Pros:

- Qualcomm has a 29-year history of developing technology at the heart of cellular phones, including Apple’s new iPhone 6.

- It has consistently delivered strong financial results over the years

- The company invests heavily in research and development, which has resulted in the creation of cutting-edge technologies such as 5G.

Cons:

- Qualcomm has been embroiled in several patent disputes over the years.

- The technology sector is highly competitive, with many companies vying for market share.

See Related: Best Mutual Funds to Invest in Today

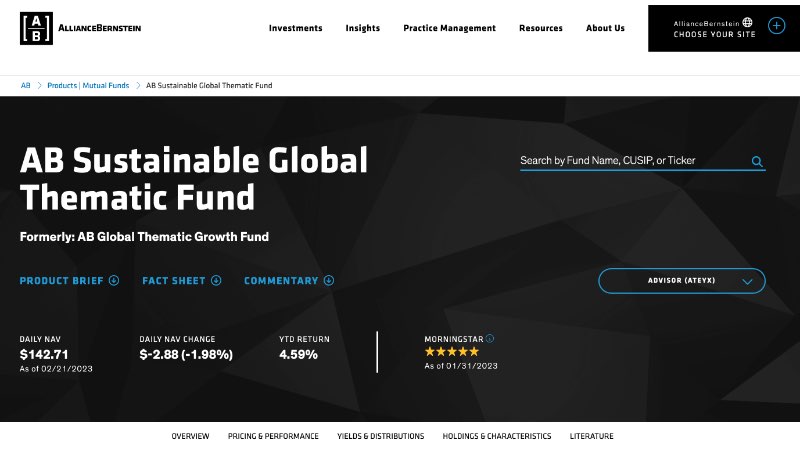

15. AllianceBernstein Sustainable Global Thematic Fund (ATEYX): Best Investment for Health, Climate, and Empowerment

The AB Sustainable Global Thematic Fund (ATEYX) is an active mutual fund that invests in companies consistent with the United Nations Sustainable Development Goals. The fund typically invests in US and international companies, focusing on health, climate, and empowerment.

The AB Sustainable Global Thematic Fund is well-diversified, with holdings across various industries and market capitalizations. This diversification helps to reduce risk and improve returns over the long term. The fund’s managers carefully balance their investments between newer and more established firms and across small-cap, mid-cap, and large-cap companies.

Investing in the AB Sustainable Global Thematic Fund is also accessible to many investors, as the fund does not require a minimum investment. The expense ratio for the fund is 0.80%, which is reasonable for an actively managed mutual fund.

Pros:

- The fund does not require a minimum investment, which makes it accessible to a wide range of investors.

- The fund is well-diversified, with holdings across various industries and market capitalizations.

- Earned a 5-star review by the Morningstar Analyst Rating

Cons:

- The AB Sustainable Global Thematic Fund has an expense ratio of 0.80%, higher than the average expense ratio for index funds. It means that investors will pay more in fees to own this fund.

See Related: Welltower Inc. ESG Profile (WELL): Is It Sustainable?

The Best Apps for Socially Responsible Investing

1. M1 Finance

M1 Finance has been recognized as one of the best apps for socially responsible investing because of its robust selection of investment options that align with environmental, social, and governance (ESG) principles.

With its “pie” feature and pre-made socially responsible investment options, M1 Finance makes it easy for investors to align their investments with personal values. Additionally, M1 Finance’s low fees and lack of minimum investment make it accessible to investors of all sizes. If you’re looking for an investment platform that values social responsibility and investment advice, M1 Finance is a top choice.

See Related: Anthem, Inc. ESG Profile (ANTM): Is It Sustainable?

2. Empower (Formerly Personal Capital)

Empower, formerly Personal Capital is a comprehensive wealth management platform offering various investment services, including socially responsible investing (SRI) under environmental, social, and governance (ESG) investing. The company partners with Sustainalytics, a global leader with over 25 years of experience in ESG and corporate governance research and ratings.

Empower is one of the best apps for socially responsible investing. It is an attractive option for investors who want ethical investments. It is because of the company’s partnership with Sustainalytics, well-diversified SRI portfolios, low fees, personalized experience, and comprehensive financial planning tools.

See Related: Betterment vs Personal Capital: Which One Is Better?

3. Betterment

Betterment is a popular robo-advisor app that offers a range of investment options. One of the most noteworthy of these options is its socially responsible investing (SRI) portfolios.

Betterment is an attractive option for socially responsible investors. Also for those who want a low-cost, hassle-free way to invest in SRI portfolios. It has multiple SRI options, an automated investing process, a partnership with BlackRock, low fees, and diversification. Betterment is an excellent choice for investors who want to align their investments with their values.

Related Resources

- Best Socially Responsible Investing jobs

- Best Socially Responsible Mutual Funds

- Best ESG ETFs to Invest In Today

Kyle Kroeger, esteemed Purdue University alum and accomplished finance professional, brings a decade of invaluable experience from diverse finance roles in both small and large firms. An astute investor himself, Kyle adeptly navigates the spheres of corporate and client-side finance, always guiding with a principal investor’s sharp acumen.

Hailing from a lineage of industrious Midwestern entrepreneurs and creatives, his business instincts are deeply ingrained. This background fuels his entrepreneurial spirit and underpins his commitment to responsible investment. As the Founder and Owner of The Impact Investor, Kyle fervently advocates for increased awareness of ethically invested funds, empowering individuals to make judicious investment decisions.

Striving to marry financial prudence with positive societal impact, Kyle imparts practical strategies for saving and investing, underlined by a robust ethos of conscientious capitalism. His ambition transcends personal gain, aiming instead to spark transformative global change through the power of responsible investment.

When not immersed in finance, he’s continually captivated by the cultural richness of new cities, relishing the opportunity to learn from diverse societies. This passion for travel is eloquently documented on his site, ViaTravelers.com, where you can delve into his unique experiences via his author profile. Read more about Kyle’s portfolio of projects.